“Now’s the time to teach your five-year-old kid about financing. If they can add, I suggest that you start teaching them about saving that money. And how their money can add up in the future. I think the more you prepare your children for the future, the better off they’ll be.”

Donald Faison

Ensuring that young people have the opportunity they need to achieve their potential as adults is the bedrock of all democratic societies. Seventeen years ago the then UK Government did something radical to help this happen, by announcing the Child Trust Fund.

There are now over six million young people aged between eight and sixteen with these accounts, with a total value of c. £9 billion. However, notwithstanding an average value of £1,500, over one million of these accounts are lost to the young person concerned and possibly a further two million are forgotten.

So this week we’re highlighting a new campaign by The Share Foundation - of which I am Chairman - to wake up the Child Trust Fund, by seeking volunteers to go into secondary schools throughout the United Kingdom and wax lyrical about this major opportunity.

Democratic capitalism is not just about companies being owned by huge financial institutions and market trading. It’s about everyone in a society having a sense of ownership and participation, and about people being able to build their own individual store of assets. Instead of starting adult working life with a great burden of debt around their shoulders, young people should have an early experience of understanding the benefits of savings and understanding money.

Gordon Brown and Ruth Kelly understood this - unlike the current Labour Party - and made arrangements to provide all young people with some resources to start adult life. For most children it was £250 at birth and a further £250 at age seven and, for the poorest 17%, these amounts were doubled.

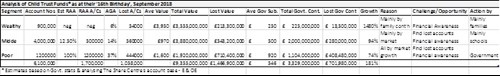

When the oldest recipients turned sixteen in September, The Share Foundation hosted a birthday party in the House of Commons as part of the celebrations. It set out a brief summary of the scheme, as below:

However there’s much more work to be done, because so many accounts are either lost or unacknowledged. There are two main reasons for this:

- Firstly, 26% of the accounts were opened by HM Revenue and Customs because the child’s parents had not taken action within one year of birth: these are known as ‘Revenue-Allocated Accounts’. Notification was, of course, sent; but in most cases its significance was not understood, and the accounts have never been joined up. Nearly half of all lost accounts - that’s 450,000 worth £0.7 billion - belong to the poorest 17% of children.

- Secondly, there’s been two changes of Government since 2010. The first (the Coalition Government) stopped making contributions to the Child Trust Fund, and introduced the Junior ISA for voluntary opening by families (except for children in care who receive a Government contribution). The second (the current Government) has been preoccupied by Brexit. With no Government acknowledgement of the scheme for the past eight years, families could be forgiven for thinking that it was all consigned to history.

But it’s not. In fact, following some lobbying, the letters sent to young people when they turn sixteen by HM Revenue and Customs notifying them of their National Insurance number now bear an encouragement for the teenager to take control of their Child Trust Fund, which they are allowed to do in the two years before getting access to their money at eighteen.

But this is not sufficient to wake up such a huge scheme, with so many unaware of its benefits.

So The Share Foundation is calling for volunteers throughout the United Kingdom, who will arrange to visit local secondary schools and talk to sixteen year-olds with Child Trust Funds, their parents and teachers, and wake up this sleeping giant.

Using a programme of financial awareness, including access to Share Radio’s version of the Open University’s ‘Managing My Money’ course, it aims to ensure that all young people are fully aware of their CTF endowment, and the contribution it can make to a successful start to adult life.

This brainchild of Gordon Brown and Ruth Kelly has been described as ‘asset-based welfare’, but because of its individual account characteristics it is more of an asset-based introduction to a more egalitarian form of capitalism, since it starts young people off in adult life with the experience of owning something, not owing money, as is the case with student debt.

If the Child Trust Fund can be shown to prove its worth, it represents a much more effective form of popular inheritance than the IPPR’s 25 year-old hand-out proposal. Not only is it a much lower cost alternative - the Government’s total commitment to the scheme was £3.3 billion, a fraction of its £9 billion worth today - but it also provides for childhood and adolescent learning about money: even though the latter may only be effective for many young people as a result of The Share Foundation’s CTF Ambassador initiative.

So it may yet prove a model which could be adopted for use not only in the United Kingdom but also across the world, as a means of empowering the next generation at all levels of society.

So don’t hold back: if you live in the United Kingdom and feel confident enough to speak to teenagers about their money, visit www.CTFAmbassadors.org.uk and apply!

Gavin Oldham OBE

Share Radio