“The downturn has all the hallmarks of affecting the youngest and most disadvantaged the most. Not simply financially, but in their experiences, training and opportunities.

A nakedly political Budget recognises that this group votes with far less frequency. A compassionate Budget ignores this fact. A smart Budget remembers these are tomorrow's voters.”

Simon French, Chief Economist at Panmure Gordon, writing in The Times

On Wednesday 3 March UK Chancellor Rishi Sunak delivers his first forward-looking Budget, charting a way forward out of the pandemic. Will it be political, compassionate or smart? It needs to be the latter.

Freed from the shackles of the pandemic by the vaccine, and from EU regulation by Brexit, this country needs new dynamism – and, while many all of us older folk will want to put our shoulder behind the wheel to help, that new energy must come from the young.

So in this commentary we focus on a fiscal framework which would encourage young people to thrive from the adventures and opportunities of adult life.

Lord Bird, founder of ‘The Big Issue’, has introduced a Bill in the second chamber entitled ‘Wellbeing of Future Generations’. Hats off to him for focusing on the long term, something which doesn't come easily to parliamentarians.

I look forward to exploring the essence of inter-generational rebalancing, a key part of introducing a more egalitarian form of capitalism, with him in due course. Once the SHARE project has started to gather momentum in Cambridge, it will be possible to inject some academic rigour into the Bill’s worthy objectives of meeting the needs of the present without compromising the ability to meet the needs of future generations.

However, Rishi Sunak could make a good start in his Budget next week.

His priority will be to set a path for recovery of the public finances, and I hope groundless (in my view) fears of inflation will not cause him to shy away from using irredeemable loan notes to shoulder most of the extraordinary pandemic debt, as we proposed on 16 November.

There are three main tax areas to watch out for: Expenditure, Income and Capital.

A government with a genuine interest in promoting individual freedom should put particular focus on the taxation of expenditure, leaving people with the choice of how to spend, and where to spend, their own money. Of course these taxes should not apply to the necessities of life, but I would not agree with Next chief executive Lord Wolfson, who argues against online sales taxes. That's understandable, of course, because Next is a major online business in addition to its shops: but the high streets across Britain need a major boost to get activity moving, and we need to give encouragement to young entrepreneurs who can contribute to a key area for employment going forwards.

Notwithstanding the fact that the Conservatives have held the hot seat at HM Treasury for nearly eleven years, much has been done to hold down threshold levels for income tax: so that, although headline rates don't appear too frightening, the higher levels of income tax cut deep into the middle ground of society. At a time when so many families have been consigned to the 80% furlough scheme for so long, this is not a time for increases to income tax and national insurance payments.

Which brings us to capital taxes, an area which has been studied closely by the Chancellor and his team. This is where it is vital that young entrepreneurs are not discouraged by increases in capital gains tax, and that we do not see imposition of wealth taxes on the living driving people overseas to seek their fortune. As Charlie Mullins, founder of Pimlico Plumbers and one of our ‘Track Record’ guests said in the Sunday Times on 21 February: ‘Founders will fly the nest if you hike taxes’.

The Chancellor should rather be looking carefully at Inheritance Tax as the way to fire up these young entrepreneurs, and particularly those from disadvantaged backgrounds. It has to be said that changes to Inheritance Tax to bring about inter-generational rebalancing have also not had a strong track record in the Conservative Party: it was Gordon Brown who introduced the Child Trust Fund, which is now starting to deliver results for thousands of young people reaching adulthood.

I hope Rishi Sunak will commit to looking closely at the work coming out of the Cambridge SHARE project over the coming years; but for now, this is an opportunity to set some principles for change. These should include:

- a commitment to move towards applying inheritance tax receipts to inter-generational rebalancing, as opposed to being absorbed into current government expenditure: not based on the IPPR's 2018 proposals, but directly addressing that challenge from the ‘Wellbeing of Future Generations’ Bill; and

- charting a path to remove the psychological burden of student debt from the shoulders of young people starting adult life, in order to give them real encouragement to build for the future.

Will Rishi Sunak rise to Lord Bird’s challenge? We shall see next week.

There's no doubt that Mr Sunak has proved to be both compassionate and smart in his handling of the pandemic - now he needs to be political and smart looking forwards.

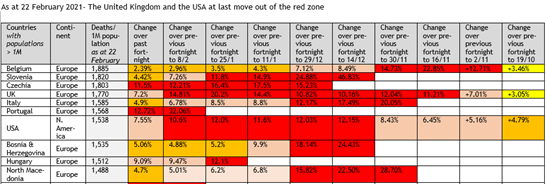

And finally - our fortnightly analysis of Covid-19 mortality rates, showing some improvement:

Gavin Oldham OBE

Share Radio