“When I was young I used to think that money was the most important thing in life. Now that I am old, I know it is.”

Oscar Wilde

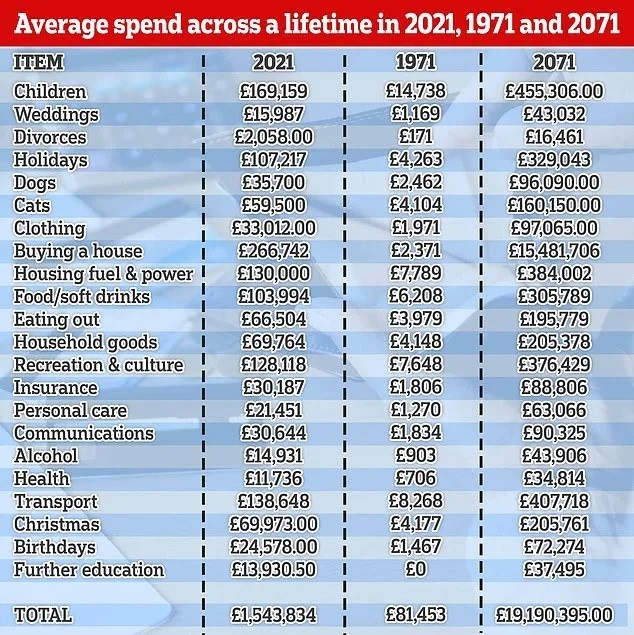

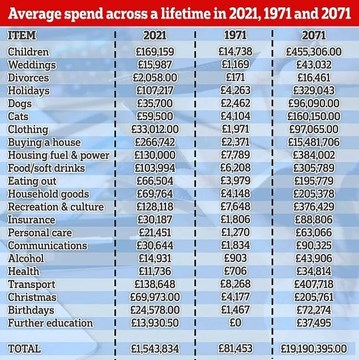

This is Money looks at an interesting research piece from Atom Bank in this episode, estimating the cost of living for an entire lifetime: £1,543,834 at 2021 prices. Neither commercial organisations nor politicians focus on the long-term that often, and it's refreshing to see this perspective.

The Bigger Picture also looks at long-term issues being addressed by John Penrose, MP for Weston-super-Mare; there are a number of think-tank events adding to the debate on his new policy paper, ‘Poverty Trapped’.

The various Share enterprises have been pressing for a more egalitarian form of capitalism for many years, not only by advocating new policies on Share Radio but also delivering change through The Share Foundation and at The Share Centre. So, this week we highlight some indications of long-term change which could bring new opportunities for the future.

The news on 2 December that Abrdn is acquiring Interactive Investor, with which Share plc/The Share Centre merged last year, will help to provide new long-term stability for personal investors. Abrdn’s focus on customer service, competitive charges and a strong fintech platform moves the retail investment platform into a group which can cater for the evolving needs throughout investors’ lifetimes, and their welcome for the new ii ‘Friends and Family’ initiative was evident in their presentation to analysts and investors.

The announcement came on the same day as the sustain.social conference for personal investors, an opportunity for people to discuss many of the long-term issues raised at COP26. We hope to carry a number of sessions recorded on the day over the next 2-3 weeks, including the lunchtime panel session on which I took part with Gervais Williams, Rodney Hobson and others.

Again, it's a sign that people are focusing on long-term perspectives; for example, one of the discussion points was on what constitutes the risk of being left with stranded assets: and not just oil company shares.

John Penrose’s focus on poverty is a welcome initiative from a Conservative politician, and I hope to contact him in order to discuss some of the proposals raised in the Z/Yen presentation in August, including inter-generational rebalancing and ‘Shares for Data’. It will be interesting to see what focus he would place on disintermediation as an integral part of broadening hope and opportunity.

Turning to long-term inflation, Atom Bank’s £1,543,834 is, of course, in today's prices, and it contrasts with the same estimate for fifty years ago - £81,453 - and for fifty years hence, £19,190,395. Their detailed breakdown is as follows:

The comparisons between 1971 and 2021 are no doubt factual, but the inclusion of ‘Buying a house’ confuses current expenditure with a capital purchase. It's best therefore to look at the 2021 - 2071 projections separating out these two. This shows total current expenditure rising by just 2.9 times over these fifty years, with the projected cost of buying a house going up by a thoroughly unrealistic 58 times over the same period, and absorbing over 80% of lifetime spending compared to today's 17%!

The comparisons between 1971 and 2021 are no doubt factual, but the inclusion of ‘Buying a house’ confuses current expenditure with a capital purchase. It's best therefore to look at the 2021 - 2071 projections separating out these two. This shows total current expenditure rising by just 2.9 times over these fifty years, with the projected cost of buying a house going up by a thoroughly unrealistic 58 times over the same period, and absorbing over 80% of lifetime spending compared to today's 17%!

It does, however, project inflation in current expenditure over the next fifty years rising by less than 20% of the increase over the last fifty years and, bearing in mind the impact of the technological revolution, I suspect that is a realistic estimate.

If you're interested to dig deeper into current expenditure inflation (goods and services) for any period over the past 811 years, I recommend visiting the Bank of England inflation calculator. This shows that £1 in 1209 was worth £2,082.79 last year - an average inflation of 0.9% pa over most of the last millenium.

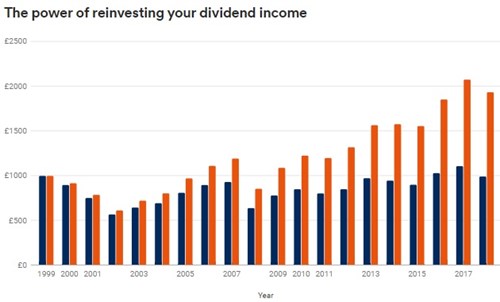

And it's worth bearing in mind the compounding effect of interest costs and stockmarket dividend yields when looking at these long-term issues - the chart below shows the substantial compounding effect of dividends for FTSE-100 investments over the past twenty years, during which actual index values have hardly moved:

Source; Cazenove Capital/Schroders

What all this shows is that long-term investing and inflation are central to understanding the bigger picture: and they are also key to achieving a more egalitarian form of capitalism. It’s no substitute to offer easy access to debt for people stranded in poverty, as we suggest in the description of this week’s The Hypnotist: we have to enable capital participation and inter-generational rebalancing in order to provide a new way forward which is fair for all.

Gavin Oldham OBE

Share Radio