“The list of qualities an investor ought to have include patience, self-reliance, common sense, a tolerance for pain, open-mindedness, detachment, persistence, humility, flexibility, a willingness to do independent research, an equal willingness to admit mistakes, and the ability to ignore general panic.”

Peter Lynch, American investor & mutual fund manager

Stock markets around the world have experienced a lot of turbulence over the past few months, and political instability in the United Kingdom certainly hasn't helped. Interest rates are sure to rise further (the next announcement from the Bank of England is due on Thursday 3rd November), although this is well built into current expectations. Shocks may continue to emerge in the future, but many investors are starting to look cautiously ahead.

That's why last Tuesday's launch of ShareSoc’s new training course ‘Investing Basics’ comes at a good time: in order both to remind seasoned investors of good practice, and to help newbies understand the dynamics of the markets and the potential for good investment. At a time when many young people are seduced by the allure of cryptocurrencies and the like, ‘Investing Basics’ provides a strong basis for planning long term returns.

The past week has also been marked by a particularly difficult reporting period for tech giants, particularly Meta (Facebook re-named). Our two Motley Fool programmes set out these challenges in some detail, and they certainly open up the case for re-thinking the future prospects for these companies. There is a clear movement away from the ‘gazelle’ stage (a term used to indicate companies with particularly high, some might say exponential, growth prospects) to a more conventional and established consideration of their future development.

I also attended last Thursday’s ‘Sustainable and Social Investing’ event in London, taking part in its panel on ESG investing opportunities and giving a talk on Egalitarian Capitalism. The prospects for good rewards for investment into alternative energy were discussed at some length — the sector has moved a long way from the experimental stage which we experienced during the first decade of this century, and Putin’s war in Ukraine has significantly lifted prospective returns on zero carbon investment (and hastened the stage at which companies which focus on fossil fuels become ‘stranded assets’).

Meanwhile there's been a significant recovery in £Sterling as the political situation in the United Kingdom has stabilised: this may allow investors to look overseas again, without fear of being caught on the wrong side of significant currency swings. The forthcoming Autumn statement on 17th November should also help to restore confidence.

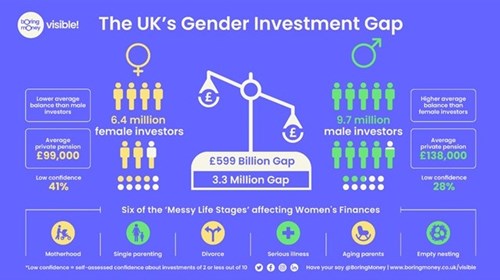

So — all in all, it's a good time to start brushing up those investment skills and looking ahead. That’s particularly important for women who are missing out when it comes to investments as shown in research being published by Holly Mackay, founder of Boring Money. She reports that:

- UK men have £599 billion MORE than women in ISAs, investment accounts and private pensions, so the UK gender investment gap is greater than the GDP of Switzerland;

- 3.3 million fewer women hold investments in the UK compared to men - the equivalent of three times the population of Birmingham; and

- The average private pension is £99,000 for women, and that’s £39,000 less than men.

To find out more visit https://www.boringmoney.co.uk/visible.

Please find below the links to the ten videos in the ‘Investing Basics’ course, and enjoy Glen Goodman's dynamic presentations — it was Glen who put together Share Radio's vibrant interpretation of the Open University’s ‘Managing My Money’ course, which is now a core part of The Share Foundation’s ‘Stepladder Plus’ incentivised learning programme for young people in care:

Links to ‘Investing Basics’ videos on ShareSoc’s Youtube channel:

- Episode 1 Introduction - https://youtu.be/FBGd1r84SxA

- Episode 2 The Miracle of Compounding- https://youtu.be/Z6DuWhb7bA4

- Episode 3 Risk and Business -https://youtu.be/1iiIR8BhSAg

- Episode 4 Supercharge your Research - https://youtu.be/I8w_64vif74

- Episode 5 Fun, Fun Funds - https://youtu.be/Z64tb-glxxM

- Episode 6 When Should I Invest? - https://youtu.be/rFKRMWlcpoY

- Episode 7 When Should I Sell? - https://youtu.be/i0Z-rKsOiik

- Episode 8 How to Buy Shares and Funds - https://youtu.be/-mCw-RNvCf4

- Episode 9 Discovering Great Investments - https://youtu.be/knux2ts0oD4

- Episode 10 Summary and Recap - https://youtu.be/EoR0CqloWI4

Enjoy!

Gavin Oldham OBE

Share Radio