“We believe that every child and young person should have a fair start in life. But this isn’t the case for many of the 108,000 young people growing up in the UK’s care system. We have been struck by the unfairness faced by many children and young people whose childhoods were spent in care, who don’t have the safety net of family to call on.”

John Lewis Partnership website

Everyone knows the key ingredients which provide the best opportunity for a young person to achieve their potential in adult life. Love and encouragement are right at the centre but, following close behind, there’s the need for some financial resources and the life skills in order to give them the best opportunity for success.

In this context, there are broadly three categories of childhood: those whose family circumstances can provide all four, those where the shortage of money and life skills is acute (c. 20% of the population in the UK), and young people in care, where their local authority is placed ‘in loco parentis’ (c. 2% of UK teenagers): these latter young lives are, more often than not, plagued with insecurity and anxiety.

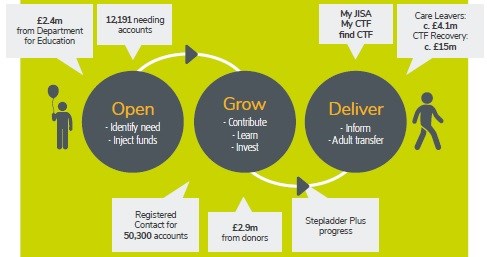

The Share Foundation has supported almost 168,000 children and young people in this last category with starter financial resources (Junior ISAs and Child Trust Funds) and life skills over the past ten years on behalf of the Department for Education, and the charity has just been appointed by the Department for a further term of four years. In addition to these financial resources it provides an incentivised learning life skills programme called Stepladder Plus, and encouragement for the future whenever it can.

During this week, The Share Foundation’s full printed 2022 annual review is being sent to members of both houses of parliament and all UK local authorities. Please do share with them to read its 2022 story, which sets out how inter-generational rebalancing works in action for the young people it supports.

Young people growing up in that second category of low-income families may receive love and encouragement in abundance at home, but they also need some resources and the necessary life skills to make a strong start to adult life. The Child Trust Fund, established by Gordon Brown and former minister Ruth Kelly, one of The Share Foundation’s trustees, is a world-leading scheme providing the basis for delivering these; but over the years leading up to adulthood it has received too little attention for low-income families.

As a result, recent industry figures show that just under half of all young adults’ accounts are not being claimed: as at the end of 2022 that amounted to over 900,000 accounts with a combined value of c. £1.3 billion. These unclaimed accounts belong predominantly to this most disadvantaged category and The Share Foundation is leading a major recovery programme for them, having thus far helped nearly 40,000 16-20 year-olds towards finding their lost accounts.

To help with life skills development, The Share Foundation introduces these young people to the 16-episode Managing My Money course produced by Share Radio in partnership with the Open University, and it plans to canvas opinion among young people who’ve found their accounts through the search facility in order to discover what impact it’s made on their early adult lives.

If you can help young people aged 16-20 (born in the UK from 1 September 2002) in finding their unclaimed accounts, please visit www.sharefound.org/talkCTF for all the resources you’ll need for running local events, including videos and background information.

Wealthier families are generally well-placed to plan for inter-generational development through inheritance planning, but it remains important to accompany asset distribution with good financial knowledge. As we said last week, there needs to be significant improvements in the education system to assist with this: for example, there is still no Financial Awareness GCSE — it can’t all be done with Maths.

Inter-generational rebalancing is central to establishing a more egalitarian form of capitalism on a continuing, permanent basis, and ideally the funds to resource the starter capital accounts and incentivised learning payments should be hypothecated from inheritance levies drawn from the estates left behind when wealthy old people die. At present, the UK Government absorbs all such inheritance tax receipts into its current expenditure: surely a clear example of ‘selling off the family silver’.

We need people in positions of leadership to think and speak much more strategically on this issue. The King’s commitment to improving the life chances for disadvantaged young people through his Prince’s Trust was a classic example of this in action, and the Duke of Sussex should learn from that example to build on his early work with Invictus rather than displaying his tirade of ‘I-itis’ (‘I-itis’ is a term I first heard from the late Lord Camoys when he was Chief Executive of BZW: it can be very helpful in a business environment).

So, let’s hope that those who read The Share Foundation’s annual review will feel inspired to lengthen their perspective beyond the typical five-year electoral term and start planning for a real transformation in the prospects for disadvantaged young people.

What drives The Share Foundation’s whole mission is its strong passion for ‘inter-generational rebalancing’: while it focuses on delivering outcomes for young people, it also recognise the need for a constitutionally reliable method of using part of the massive inheritance of wealth in both public and private sectors in order to fuel the prospects for disadvantaged young people, in order to help them achieve their potential in adult life.

At Share Radio we hope you agree with this passion, and will do what you can to bring love, encouragement, some resources and life skills to the generations that will follow us.

Gavin Oldham OBE

Share Radio