‘A lot of investors are more fearful of investing in the real economy than in cryptocurrency … now is the time for a long-term public campaign that would demystify investing.’

Dame Julia Hoggett, CEO London Stock Exchange

There's been considerable debate over the last few months about whether Rachel Reeves would make a significant reduction in the annual subscription limit for Cash ISAs, which is currently £20,000. It’s said that a very strong letter from the Building Societies Association has resulted in the Chancellor changing her mind, and this is borne out by the lead discussion in this week’s This is Money.

BBC Money Box also discussed the issue at some depth on Saturday 12th July, and interviewed someone with both a parent in a care home and a son saving up for a first-time house purchase in order to show how critical it is to have access to risk-free cash when time is not on your side. Paul Lewis also interviewed financial advisor Louise Claro, Managing Director of Circle Financial Services, who said that you need to be looking at a time span of 5-7 years to be confident in stock market investment as opposed to cash: a sound professional approach to risk mitigation and reward maximisation.

The debate over Cash ISAs is reported to be linked to Rachel Reeves’ determination to inject new life into the London stock market, which is also the reason why Dame Julia Hoggett, CEO of the London Stock Exchange, has called for a ‘Tell Sid’ style campaign in order to encourage the public to invest as part of efforts to rescue Britain's faltering equities market.

However, it is not an advertising campaign and certainly not a wealth tax (which would increase further the substantial exodus of millionaires from the United Kingdom) that we need. In order to address public finances, the solution is a mandatory private health insurance for wealthy old folk. Meanwhile, so far as the stock market is concerned, a significant reduction or abolition of stamp duty on share purchases should be funded by a correspondingly significant reduction in the tax breaks which privilege Private Equity businesses. These organisations act as vultures for the quoted stock market, and they are the main reason for its demise over recent years.

These changes would help considerably to encourage retail investment businesses such as The Share Centre to re-appear, which are now sadly conspicuous by their absence.

The interplay between stock market investment and cash has also been very significant for the Child Trust Fund scheme, on which we commented last week.

Just over 1 million of these accounts out of the 6.1 million opened for all children born in the United Kingdom from September 2002 to January 2011 were held in cash. The remainder were held in stock market funds, as the then Labour Government very sensibly decreed that the nearly 5 million standard ‘Stakeholder’ accounts should be invested thus, and as a result they have increased very substantially in value over the past twenty years or more.

The Share Foundation’s analysis on www.CTFAmbassadors.org.uk shows that there are broadly three societal segments holding these accounts:

- The 15% most wealthy, which have generally been boosted by additional family contributions, and most of which will remain invested in stock market investments for the future;

- The broad middle ground, the largest segment comprising about 70% of the accounts; these are less likely to have received additional contributions. It is also this segment which has been most heavily deposited into cash, and for this reason these accounts will have seen little growth over the years compared to those invested in stock market; and

- The lower-income segment, which have benefited not only from double the standard initial Government contributions but also from strong stock market investment over all these years. Accounts held for older recipients who received a second payment at the age of 7 will typically be worth about £3,000 — a life-changing amount for someone from a low-income background, if they knew anything about their good fortune.

Unfortunately, a very large number of this last segment don't, however. As a result, their accounts remain unclaimed as these young adults get older: 23% of them are already aged 21 or over.

The stock market has done its work in generating real value for these young people: now the current Labour Government has to do its bit to enable these funds to be released to their rightful owners, so that the previous Labour Government's objectives do not end in failure for the poorest in society.

The Share Foundation, which has already linked nearly £200 million of Child Trust Funds to account owners through its search facility https://findCTF.sharefound.org, has been arguing for an ‘Automatic Release at 21’ process for HMRC-allocated accounts for the past eighteen months. These are the 28% of CTFs which were opened by HM Revenue & Customs because the child’s family had taken no action by their first birthday.

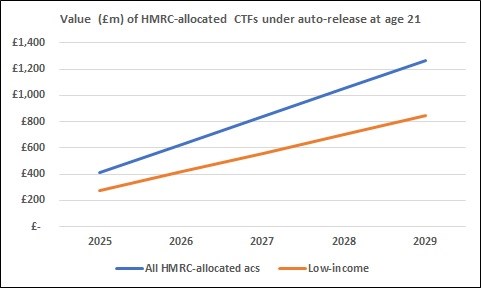

There are already £275 million of CTFs which would be immediately released to low-income young adults if this scheme was in place now. This backlog is now increasing at the rate of £140 million each year, so that by the end of this Parliamentary term there will be nearly £1 billion lying dormant and unclaimed for low-income young adults if no action is taken to enact The Share Foundation’s proposal.

This is a hot issue which demands attention. Last week I met with Emma Reynolds, Economic Secretary to HM Treasury, to stress the urgency for this decision; our proposal has already received strong support in both Houses of Parliament. We've also written to Gordon Brown, whose legacy for low-income young people would be seriously at risk if no action is taken to introduce the necessary regulation and logistics (which The Share Foundation has offered to operate).

The chart below shows how the value of matured, HMRC-allocated Child Trust Funds accounts will increase over the remainder of this Parliamentary term if no action is taken. By that stage it will be impacting nearly half a million young adults — it is indeed a big issue.

What the Child Trust Fund scheme has shown is how a blend of stock market investment and cash availability at the right time provides the best results. As we said last week, individual ownership is vital for building a sense of responsibility and freedom for all, and having a stake in stock market investments makes that come alive.

It is not, therefore, a case of ‘either/or’ but ‘both/and’ which will deliver a really egalitarian form of capitalism.

A footnote: it’s interesting to see that President Trump has introduced a “Money Account for Growth and Advancement” (MAGA) starter capital account in the United States as part of his “One Big Beautiful Bill Act”, which follows much of the original Child Trust Fund design. He clearly hasn’t read our CTF Mark 2 proposal, as it carries forward several of the disadvantages of the original scheme: for example, no focus on young people from low-income backgrounds, no embedded features of incentivised learning, and an even more complex withdrawal structure which excludes automatic release at 21. But something is still better than nothing: we just need to explain the logic of inter-generational rebalancing, and why he should be modelling his initiative on our CTF Mark 2 proposal.

Gavin Oldham OBE

Share Radio