“Elephants don’t gallop.”

Jim Slater

- explaining why he prefers small cap shares

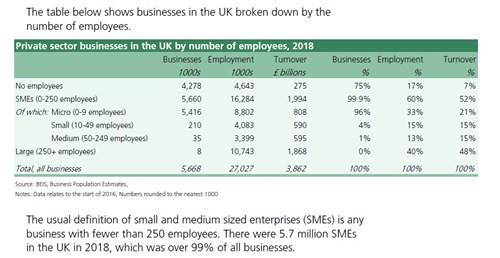

One of the research papers which slipped out unnoticed in December into the House of Commons library was a briefing paper on UK business statistics, showing the huge contribution made by small and medium-sized businesses, which provide 60% of all private sector employment, for 16.3 million people, and 52% of the turnover.

Meanwhile, over the past 23 years, small and medium-sized growth companies have raised £110 billion on the London Stock Exchange’s AIM market (Alternative Investment Market). It is one of the UK’s great successes, not only in raising investment capital but also a vibrant market on which to trade. As we approach decision time on Brexit, it’s worth considering why London has succeeded where few other European markets have trod, and why it’s so important for the future.

So this week we look at the stats on this vital part of the UK economy, and how the AIM market provides the opportunity for everyone to share in SME ownership.

The lion’s share of employment in the United Kingdom is provided by small and medium-sized businesses, and their vibrancy accounts for so much of the technology and new ideas which we now find so commonplace.

Here’s the key employment analysis from that House of Commons briefing on business statistics:

Source: House of Commons Library Briefing Paper Dec 18

At the seed level, entrepreneurs and business angels have to dig their hands into their pockets; and, of course, there are Venture Capital funds to help them test out their ideas and bring them to market.

“Buy the stocks of small companies below their economic value, let the companies grow, and resell them as proven successes at full economic value. Individuals often sell small companies below their economic value and buy mature companies at full value, thus providing the other side for our trades.”

Ralph Wanger

Individuals play a huge part in getting businesses underway, whether as employee share owners, family members and friends, or customers - who often want to help make something go from ‘good to great’: they just need to take care of Mr Wanger's cautionary second sentence!

The Government has also recognised their vital role in helping companies to grow, and it has made two substantial reforms over recent years: abolishing Stamp Duty on AIM transactions, and allowing these investments to be held in ISAs as well as SIPPs. It’s also provided continued ‘Business Assets’ relief to enable transfers and inheritance changes to take place without hitting tax barriers.

Across Europe it’s only Germany’s SDAX which has tried to emulate London’s AIM market, and that’s a shadow in comparison. Meanwhile a very significant proportion of personal investor trading is now focused on the London AIM market.

Of course AIM has experienced a similar contraction in the number of quoted companies as has the main market: from 1,347 companies in 2007 to 926 in December last year. We referred to this demise of public listings over a year ago, and suggested a range of measures that could be taken to encourage a more participative form of capitalism, which too often becomes intermediated by Private Equity.

But the vibrancy of the AIM market gives us much to celebrate in the UK, and it may be a vital ingredient in enabling us to succeed economically post Brexit.

So, as we move into a new year with so many challenges, let’s not forget the essential role played by UK small and medium-sized businesses, and the London Stock Exchange’s junior market which serves them.

Gavin Oldham OBE

Share Radio

Note: If your investments fall in value, you could lose money. Tax allowances and the benefits of tax-efficient accounts could change.