“I agree with Nick.”

David Cameron & Gordon Brown (UK Election debate, 15 April 2010)

The recent collapse in the stock price of Meta (formerly Facebook) has, for the first time, put a capital value on the personal data harvested by this tech giant. There have been two developments causing this over the past few months:

- firstly, Apple withdrew information on the online journeys taken by customers as they moved across the web and its apps unless customers had specifically authorised such disclosure; and

- secondly, over the past week Google placed similar restrictions on its Android facilities.

The stock price of Meta has tumbled 42% over the past six months, wiping over $400 billion off the value of the company.

There's been another major development at Meta over the past week: Sir Nick Clegg has been appointed President of Global Affairs, with Mark Zuckerberg now concentrating on development of the Metaverse. This means that the former UK deputy prime minister is in charge of global strategy: and that may offer an opportunity for a radical new approach to data storage and harvesting.

So in this commentary we look at how these developments could move forward a proper recognition of the value of your personal data, and the major implications that it could have on the world economy.

The fall in Meta’s market capitalization of over $400 billion may sound a lot, but bear in mind that the company claims to have over three billion customers worldwide, as shown in this chart.

The fall in Meta’s market capitalization of over $400 billion may sound a lot, but bear in mind that the company claims to have over three billion customers worldwide, as shown in this chart.

Their business model is built on data harvesting more than most, but the astronomical market valuations of all the tech giants are based primarily on the manipulation of our personal data for advertising purposes. In a comment article in The Times on Friday, Emma Duncan wrote: ‘If you're in the data harvesting business, you get custom by attracting people, who are attracted by the presence of other people. If people stop peeling off there's nothing to sell’. She could have added ‘If their data becomes inaccessible there’s nothing to sell’.

Her argument is that the main problem is monopoly - that Facebook has deliberately concentrated its power by buying up rivals. Indeed, Mark Zuckerberg said in a 2008 email which is now with the US Federal Trade Commission that ‘it's better to buy than compete’.

But Meta is not alone in respect of both data harvesting and buying up potential rivals - they’re all at it. Amazon, Apple, Google, Tik Tok etc.. – and Tik Tok has shown that it is possible to compete in the social media marketplace. However, those who control the levers over operating systems - Apple and Google - are the real masters of the universe, as they can deprive social media giants of that data circulation, the weapon that has now caused the collapse in Meta’s market capitalisation.

Ben Marlow, writing in the Telegraph business section on Friday, said ‘Even in Silicon Valley the knives are out for Zuckerberg: first Apple blocked the mobile web-tracking technology on which much of his advertising empire depends. Now Google has announced similar changes on its Android smartphone software’.

Whether by bearing down on monopolistic behaviour or by restricting data flow, regulation can be a very negative way of controlling tech giants. It's much better to find solutions which create new opportunities and Sir Nick Clegg, in his new role as President of Global Affairs, is ideally placed to do that.

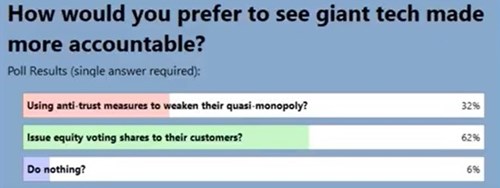

We therefore invite him to introduce the first tech giant adoption of ‘Shares for Data’, one of the key elements of our proposals for egalitarian capitalism. If customers’ willingness to allow their data to be stored and harvested is rewarded by the issue of equity stock, Meta will be presenting both an answer to the regulators and a challenge to Apple and Google, which they will not be able to ignore.

Such a major step forward, which was warmly welcomed when I presented it at the Z/Yen seminar last August.

It would raise the global profile of Meta and its constituent businesses so that people would recognise that it genuinely cares for its customers, and wishes them to share in its wealth creation.

A clear statement of intention will also kick-start the process of encouraging securities regulators and administrators across the world to provide a global platform for individual stock ownership: thus paving the way for a global economic system which will encourage a gradual evolution from wages to dividends – a key feature for the brave new world of Artificial Intelligence in order to avoid a huge proportion of people becoming subservient to Universal Basic Income.

It would also enable people across the world to have a voice in steering the future direction of Facebook, WhatsApp, Messenger and Instagram, providing a strong example of share/stock owner democracy which others could follow.

Meanwhile, by being the first tech giant billionaire to demonstrate such a profound commitment to sharing wealth, Mark Zuckerberg would be setting a powerful example for Jeff Bezos, Bill Gates, Larry Page and others to follow.

At the end of her article in The Times, Emma Duncan hopes Sir Nick could conjure up an alternative Metaverse (albeit, in her case, in the context of Lib Dem recovery). If Meta were to introduce this global policy of ‘Shares for Data’, he would indeed be providing a radical new alternative, to which all could subscribe.

Gavin Oldham OBE

Share Radio