“The ground of a certain rich man yielded an abundant harvest. He thought to himself, 'What shall I do? I have no place to store my crops.' Then he said, 'This is what I'll do. I will tear down my barns and build bigger ones, and there I will store my surplus grain. And I'll say to myself, “You have plenty of grain laid up for many years. Take life easy; eat, drink and be merry.” '

But God said to him, 'You fool! This very night your life will be demanded from you. Then who will get what you have prepared for yourself?”

Luke ch12:16-20

Hardly a day goes by without yet more evidence of our approach to empowering the next generation being wholly dysfunctional. Of course, the global issues of climate change and conflict both show a flagrant disregard for the conditions in which our grandchildren will have to live, but in this ‘Thought for the Week’, we’re referring to our economic approach to inheritance, both personal and systemic.

The Telegraph ran a features article by Peter Stanford last Friday headed ‘I won't inherit from my parents — it's going straight to my children’, reflecting on the increasing tendency for asset-rich old people to sit on their cash much longer than in earlier generations. A fortnight ago we commented on Janice Turner's article in The Times and its criticism of the short-sightedness of our gerontocracy under the title ‘Generational Discontent’.

Now we see President Biden's bold move to cancel student debt being viciously criticised by Lionel Shriver in The Times last Saturday, based on an ‘explosive eruption’ of criticism in the Wall Street Journal. Meanwhile here in the UK, the oldest recipient of Child Trust Funds reaches their 20th birthday at the beginning of September, but over £1 billion is waiting to be claimed by young adults, almost all from low-income backgrounds.

It's hard to avoid the conclusion that we are a selfish and short-sighted generation of ‘Baby Boomers’ — we need to stand back and take stock of our failure to empower coming generations.

At the heart of this challenge is the fact that, as our opening quotation says, we can't take it with us when we leave this earth. An individual’s wealth will be passed on to a mix of their family and friends, and good causes as they may direct — but also to the Government, which shows no better sense of long-term strategy than the most short-sighted of us older folk. This is because it spends inheritance tax receipts on current day-to-day spending, while at the same time building up a massive public debt burden with which our children and grandchildren will have to struggle.

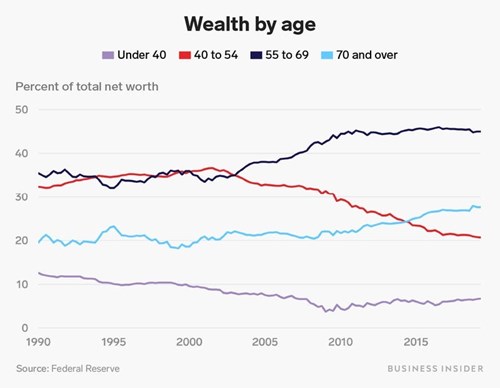

There are good statistics for privately-owned wealth by generational cohorts, provided in both the United Kingdom and the United States. One of the clearest reports, using statistics from the Federal Reserve, was published in Business Insider magazine in October 2020. This tracks the proportion of wealth held by Baby Boomers and Millennials, and it draws attention to the fact that 53% of total wealth is owned by the former, compared to just 4.6% for the latter. Over the past twenty years the gap has widened by over 50%:

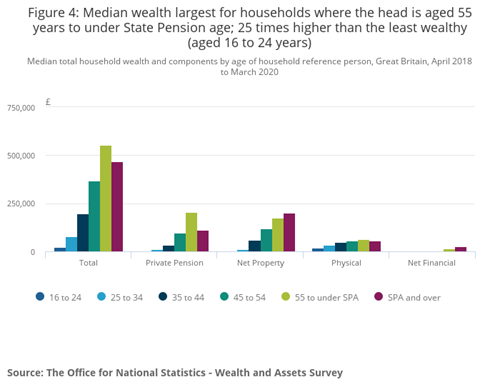

The Office for National Statistics shows a similar situation in the United Kingdom:

Within families, there's a natural reluctance to pass on assets until older folk feel comfortable about meeting their health and care requirements; but the fact that generations are also so stretched and often splintered adds to the challenge for a structured approach to inheritance, as David Willetts commented in his book, ‘The Pinch’. It's also a fact that wealthier families have fewer descendants: therefore increasing the need for Government to come up with a structure for inter-generational rebalancing without simply absorbing it into current government expenditure — by putting private capital to work with young people from low-income backgrounds while preserving its status as private capital.

It would also assist both private and public finances if people reaching state retirement age (66 in the UK) were given training on how to look after their bodies and minds in their senior years in order to reduce the financial burden on both their assets and the state.

The progressive element of Joe Biden’s student debt cancellation programme shows that he definitely gets the message, and he should not be castigated by Wall Street Journal readers for lifting the burden from these younger generations. However, it's a one-off, politically-charged initiative which doesn't deal with the long-term systemic challenge.

The best long-term strategic initiative to date was established in the UK by Gordon Brown and Ruth Kelly in 2002: the Child Trust Fund. It could have been significantly more progressive, thereby reducing its overall cost by excluding wealthy households; and it should have been hypothecated from inheritance levies on an ongoing basis. However, it was designed as a long-term solution for empowering young people from disadvantaged backgrounds.

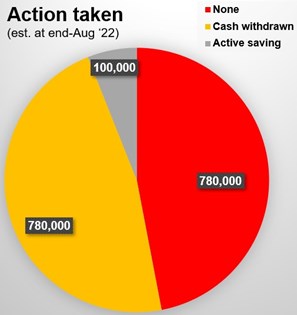

Following its closure from new Government funding in 2011, nearly two million young people have now reached adulthood with these individually-owned accounts: but, because so little Government attention is given to linking the funds to their owners, there are now nearly 800,000 young adults whose money is slipping towards dormancy. The Share Foundation is doing its best to tackle this: if you have contact with 18-19 year-olds in the UK, please consider using its video and other materials to run events for them.

Following its closure from new Government funding in 2011, nearly two million young people have now reached adulthood with these individually-owned accounts: but, because so little Government attention is given to linking the funds to their owners, there are now nearly 800,000 young adults whose money is slipping towards dormancy. The Share Foundation is doing its best to tackle this: if you have contact with 18-19 year-olds in the UK, please consider using its video and other materials to run events for them.

There are so many examples of young people who, assisted by a modest amount of starter capital and the necessary life skills to manage it, achieve great things in adult life. Even in the last few days we've seen 17 year-old Mark Rutherford emulate his sister Zara in flying solo round the world: they couldn't have completed such stunning achievements without the help of a supportive older generation.

As the Conservative leadership election draws to a close, and as the debate over student debt cancellation hots up across the Atlantic, we need serious systemic analysis of how to cascade private wealth down the generations. There’s no excuse for the Baby Boomers sitting on their hands and their wealth in anticipation of death, demonstrating a severe case of myopia; in all respects, economic as well as environmental, and in pursuing the search for peaceful coexistence, we need to plan ahead.

Gavin Oldham OBE

Share Radio