“A customer is the most important visitor on our premises —

- A customer is not dependent on us: we are dependent on him/her.

- A customer is not an interruption in our work: he/she is the purpose of it.

- A customer is not an outsider in our business: he/she is part of it.

- We are not doing a customer a favour by serving him/her: he/she is doing us a favour by giving us an opportunity to do so.”

attributed to Mahatma Gandhi

TikTok and John Lewis are facing very different challenges, which could both be solved by a very similar solution: customer stock ownership.

In TikTok's case, its Chief Executive Shou Zi Chew was subjected to a major grilling from the American Congress over concerns that its huge data harvesting operation is presenting a major security threat. In John Lewis’s case, its business model is in need of serious revision and the injection of new funds, which are challenging the essence of its employee partnership.

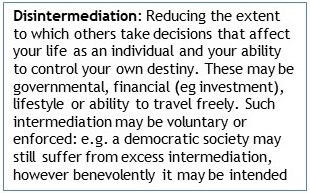

In our heavily-intermediated world, where big government and big financial institutions hold so much sway, it's common for business to fall foul of conflicting interests. That's why stock ownership by individual customers and employees can be so effective in resolving these challenges, and why it comprises such a key part of our egalitarian capitalism agenda — the presumption in favour of disintermediation. So, in this commentary we consider how both TikTok and John Lewis could benefit from this perspective.

In our heavily-intermediated world, where big government and big financial institutions hold so much sway, it's common for business to fall foul of conflicting interests. That's why stock ownership by individual customers and employees can be so effective in resolving these challenges, and why it comprises such a key part of our egalitarian capitalism agenda — the presumption in favour of disintermediation. So, in this commentary we consider how both TikTok and John Lewis could benefit from this perspective.

TikTok has become the most successful social media business in the world, considerably ahead of Instagram, its nearest competitor. It has a remarkably comprehensive offer to businesses with a sophisticated Ads Manager routine and the ability to generate video creatives at the push of a button, with a substantial contribution coming from its Artificial Intelligence engine.

However, its owner Bytedance is firmly domiciled in China and, understandably, the Americans are very concerned about the leakage of data to the Chinese state. The Chinese government must understand this — after all, they banned Facebook in 2009 from operating in their country.

TikTok has already been banned from government-owned smartphones and other devices throughout the U.S., the UK and the European Union, but now they're threatening to go much further unless Bytedance disinvests. It's a major regulatory challenge.

TikTok’s customer base is 150 million in the United States alone, and it has over 1 billion users in 150 countries across the world. These are the people whose data is being harvested to enable wealth creation, and it’s only right that they should have both a share in these profits and a voice in terms of its governance.

However, faced with the existential threat of legal exclusion from access to much of the free world, Bytedance may well agree that mass democratisation of stock ownership would be preferable to disposal of the TikTok business, and American legislators should look favourably at this alternative.

The John Lewis challenge is very different.

Here, the need is investment in the face of an outdated business model — but their ownership structure is so deeply embedded in and appreciated by its staff and customers that it is also faced with an existential threat if it cannot reconcile these challenges in raising the necessary investment. The Sunday Times reported a partners’ (staff) survey carried out last week in which 85% of responders did not have confidence in the company’s ability to deliver its strategy.

The John Lewis Partnership needs to raise up to £2 billion in order to upgrade its technology and data analysis (there’s the data harvesting link again!), but nowhere have I seen any reference to approaching its loyal, substantial and generally well-heeled customer base for raising this money. There has clearly been some experimentation with diversification and joint ventures: for example, a £500 million deal was signed with abrdn to build rental properties: but all, it would appear, with an institutional mindset.

But this is a classic case where individual customer stock ownership could come to the rescue, providing a parallel branch of customer partnership alongside the employee participation. From a personal perspective, I would like to feel that abrdn — which purchased the retail investment business resulting from the merger of The Share Centre into Interactive Investor — could take the lead in steering this significant development as a retail flotation: indeed, if The Share Centre was still in operation, I would be putting forward such a course of action.

Customer stock ownership is valued in many businesses, even though it doesn't yet share the maturity of employee stock ownership: where organisations such as Global Shares (now owned by JP Morgan) have led the way for international expansion.

There are so many businesses which would benefit from this approach. In April 2018, we pressed hard for customer stock ownership at both Amazon and Costa Coffee (the latter following the Whitbread decision to demerge its subsidiary): but Amazon blocked the initiative, and Coca-Cola bought out Costa Coffee for £3.9 billion.

This led to our September 2018 commentary, ‘Big business should wake up and smell the coffee’. I suggest both John Lewis and TikTok should read this analysis and try to apply it to their own situations. It's hard to argue against disintermediated ownership in any situation which is so directly relevant to people’s lives.

Finally — please do join the SHARE conference on 14th April, either online or in person in Cambridge, if you'd like to hear more.

Gavin Oldham OBE

Share Radio