“HMRC should work in partnership with other parts of government to ensure that all providers are incentivised to establish contact with all young people whose Child Trust Funds they manage, and so that they earn fair fees, proportionate to their level of activity.”

Recommendation 2, Public Accounts Committee 26th July ‘23

Last Wednesday the Public Accounts Committee published its report into the Child Trust Fund scheme, which provided over six million young people born in the United Kingdom between 1st September 2002 and 2nd January 2011 with individual accounts now each worth an average of £1,900. As we reported on 22nd May, a large proportion of these are now adults — nearly 40% as of today (31st July) — and an estimated 42% of these accounts remain unclaimed, mainly because their young owners don't know anything about them.

The young people who are missing out are predominantly those whose accounts were opened for them by HM Revenue and Customs because their parents had taken no action by their first birthday. The majority of these accounts received an additional payment award: so the oldest cohort, those who are now adult, received two tranches of £500 from government which, after investment growth over the past 18 years, is typically now worth c. £2,000. There are now estimated to be over one million Child Trust Fund accounts unclaimed by young adults, worth c. £2 billion in total.

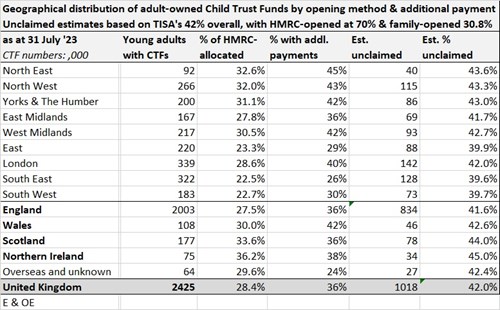

On Friday I was interviewed by BBC Radio Ulster: Northern Ireland is particularly impacted, having the highest rate of HMRC-allocated accounts (60% higher than the South-East of England), and 38% of their accounts received the additional payment award. Here is a regional estimated analysis of the current state of unclaimed adult Child Trust Funds:

The Public Accounts Committee also reported that account providers are in most cases sitting on their hands, happy to receive an estimated £100 million each year from CTF fees — most of which goes straight to their bottom line. The Share Foundation described these fees, set at the maximum permitted 1.5% level, as ‘very high indeed for fund management’. So — this week we are proposing a radical new approach to tackle this complacency among account providers, which we hope will be tabled in Parliament when it returns from the summer recess.

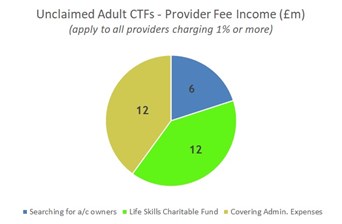

Our proposal is designed to do precisely what the Public Accounts Committee proposes in their second recommendation, which forms the quotation for our commentary today. We propose that the account providers’ expenditure on reaching young adults with unclaimed accounts, whether direct or through other promotional work, together with their contribution to tracing costs, should be treated as an allowable expense against their gross fee income from the fees charged to unclaimed young adult Child Trust Funds.

The remainder of this income, for those providers charging 1% or more in fees, should be split 50:50. Half of it should be paid into a charitable fund for increasing the life skills and financial awareness of young people from disadvantaged backgrounds, such as those from low-income households or in the care of local authorities. The other half could be used to cover their legitimate expenses for administering the accounts. These expenses are very modest because, by definition, they have no contact details for these young adults: so they cannot mail out statements and have no call for customer service facilities.

To put this proposal in monetary terms, the annual income from these unclaimed adult accounts is at least £30 million each year (‘at least’, because these older accounts are the most valuable due to their second stage payment awards from government). If 20% of this — £6 million per annum — was dedicated to searching for the rightful owners of these accounts, this would release £12 million towards improving those life skills, including financial awareness.

To put this proposal in monetary terms, the annual income from these unclaimed adult accounts is at least £30 million each year (‘at least’, because these older accounts are the most valuable due to their second stage payment awards from government). If 20% of this — £6 million per annum — was dedicated to searching for the rightful owners of these accounts, this would release £12 million towards improving those life skills, including financial awareness.

That would be a huge boost for helping disadvantaged young people to achieve their potential in adult life: for example, the ‘incentivised learning’ Stepladder Plus programme for young people in care is estimated to cost just under £2 million per annum. Incentivised learning is hugely effective for disadvantaged young people, achieving an attitudinal transformation as they work through the steps.

Our proposal therefore combines the characteristics of both carrot and stick. For those providers who work hard to link unclaimed adult accounts, it minimises the amount they will be required to set aside for funding the work of inter-generational rebalancing. For those who prefer to remain sitting on their hands while the accounts which they administer drift towards dormancy, it will ensure that they help fund opportunities for other young people from disadvantaged backgrounds from their substantial fee income. No doubt the Financial Conduct Authority will also pick up the message from the Public Accounts Committee to require providers to work harder at linking these adult accounts.

Finally, the Public Accounts Committee have also recommended that HMRC should partner with the Department for Education and the Ministry of Justice (and their equivalents within the devolved nations), and other bodies, in order to ensure that the message about unclaimed accounts is getting through. As they say in their report, “The engagement of The Share Foundation to manage Child Trust Funds on behalf of children in care has given a focus to those accounts and should be a lesson for HMRC on how to make its schemes work well for hard-to-reach groups”.

The Share Foundation has already linked nearly 36,000 young people with their lost Child Trust Fund accounts via its search facility, https://findCTF.sharefound.org .

Dame Meg Hillier, Chair of the Public Accounts Committee, concluded her press statement as follows:

“The aims behind Child Trust Funds are laudable - for young people to come into a pot of money on reaching 18, with the promotion of financial literacy and good savings habits. But many young people are unaware that they have money waiting to be claimed. Schemes like these need careful planning so that they are not forgotten at the point when they mature.

“Our inquiry heard a world of difference can be made to care leavers in particular, with Funds acting as a jump-start into adult life. In an ongoing cost of living crisis, our young people need every bit of support we can give them. HMRC still has time to make sure that CTFs are given the chance to be the boost to young people’s futures which they were designed to be.”

Gavin Oldham OBE

Share Radio