“This isn’t about legacy-building; it’s about getting ready for prime time.”

James Gorman, Chair & CEO Morgan Stanley

The news that Morgan Stanley has acquired American online stockbroker E*Trade for $13 billion rather eclipses the news (included in our newsletter on 17th February) of Share plc/The Share Centre combining with Interactive Investor. Mind you, the size of E*Trade, with its 5 million personal investor customers and assets under administration of $360 billion, is somewhat larger than The Share Centre’s 300,000 customers and £6 billion assets under administration.

There is no doubt that retail investment businesses offer strong potential for growth in the years ahead, and large corporates and private equity firms see those opportunities across the free world. However if they’re wise, their control tenure in this space will be short-lived, since retail investment businesses thrive best when they’re owned by their own customers.

So in this commentary we take a look at how private equity provides businesses with the opportunity to re-organise for the future, and why releasing their investments in a timely fashion is a key part of generating financial returns.

I was, for 18 years, a member of the Church Commissioners’ Assets Committee, responsible for watching over the Church of England’s store of investments which generate 15–20% of its income. It is one of the most professional and responsible investment teams in the world and, for me as a retail investment specialist, it provided an amazing insight into the world of institutional investment.

One of its core investment sectors is private equity, responsible for generating highly impressive returns for the Church’s mission and ministry.

Listeners will know that one of my continual ‘beefs’ is that personal investors can’t usually get a look in with private equity, because it is those huge institutional investors - like the Church Commissioners - who fuel the funds which finance their activities. Normally private equity firms prefer to avoid the glare of publicity and the public spotlight that sometimes comes with embracing personal investors.

So, wearing my Share plc Chairman’s hat for a moment, it was not a surprise to receive a lot of questions last week about private equity, because the transaction we announced last Monday provides one of those rare opportunities for personal investors to become shareowners in a major private equity investment.

I cannot, of course, comment on this specific case, and particularly not offer any kind of expectation as to how things may turn out for those personal private equity investors. But it is worth in this commentary taking a general look at the way private equity works.

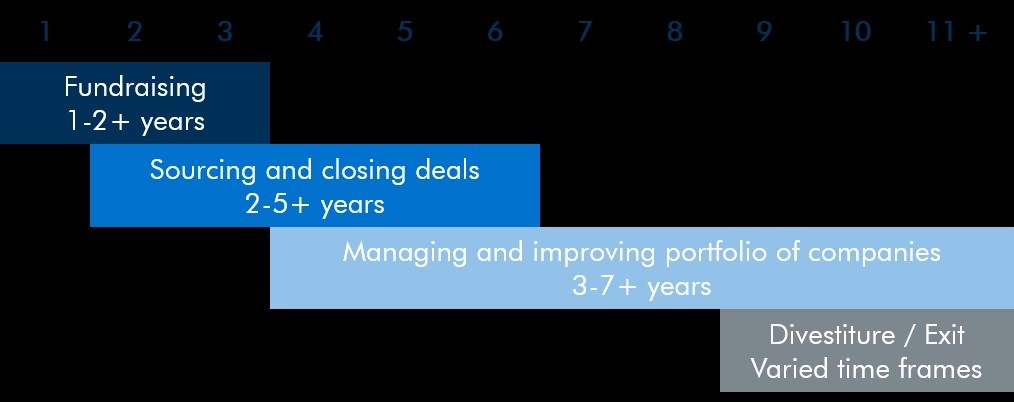

There are many different business models for private equity firms, but the overall aim is to raise money in a fund to finance acquisitions and organisational change in order to carry out those actions as efficiently and as swiftly as possible; then to exit the business(es), providing a really good ‘internal rate of return’ for the investors who funded it.

For those interested to do a bit of in-depth reading, there’s a very good guide produced by the British Venture Capital Association.

Although it is very rare for personal investors to be welcomed into the initial fundraising, the more enlightened private equity firms accept that personal shareowners and shareholding employees of companies undergoing organisational change should be welcomed to join in the downstream benefits that often come when a private equity firm exits.

As the diagram above indicates, this could involve holding the business’s shares for a number of years: it all depends at what part of the cycle they’ve ‘joined the party’. And, during that period, their holding will be illiquid - it cannot be traded in the open market, although sometimes a ‘bulletin board’ trading facility is put in place. But, of course, such personal shareowners prepare for that illiquid period ‘eyes open wide’ – it’s not like the Woodford debacle, when a liquid open-ended fund was found to have far too many private investments (see our commentary on 10 June 2019).

However, driven by the desire to deliver the best ‘internal rate of return’, the exit will come as soon as the private equity firm determines that the time is right. It may be by an IPO flotation on the stockmarket, or it may be as a trade sale - it depends on things like the multiplier of earnings to market value found in comparable businesses listed on the stock market, or on the premium which a tech giant might bid for a really ground-breaking piece of technology.

I would like to see as many exited businesses as possible going into the public stockmarket, so that more people can enjoy straightforward investing: sharing in the benefits of economic growth - hence our recent proposals to the new Chancellor, Rishi Sunak, for a new Task Group designed to boost democratic capitalism.

But the central point is that private equity does play an important role in facilitating organisational change, and that it is a central factor in enterprises managing to keep abreast of our fast-moving business environment.

Gavin Oldham OBE

Share Radio