“I've been making the NHS's case that we need significant and sustainable funding increases to meet the demographic challenges we face, and the prime minister completely appreciates that.”

Jeremy Hunt - June 2018

At first sight you might think that the title of our Thought for this week should be ‘Health of the Economy’, rather than ‘Health and the Economy’, but please bear with us!

Let's first discuss the problem. The former Chancellor’s proposals in his mini-Budget were like a sugar-coated pill — the sugar-coating was the reduction in the basic rate of income tax (now cancelled) and cancelling National Insurance increases, but the real work to achieve supply-side growth, rather than foment demand-led over-heating, was to be done by cancelling that increase in Corporation Tax and abolishing the top rate of income tax: both of which have now gone.

The mini-Budget was supposed to drive investment and growth through exports, even if there were major questions over workforce capacity — as we noted three weeks ago. However now we're left with just part of the sugar-coating, accompanied by at least £20 billion of potential extra borrowing costs. And we have to avoid over-heating an already stretched economy with inflation and still higher interest rates.

This is why balancing the books must be done, as we commented last week. There are routes to growth in the medium term as we proposed on 26th September, but the first priority is to restore fiscal balance so far as possible, and we’re still at least £20 billion short on that.

So this is where health comes in, and we're fortunate to have in the new Chancellor the longest-serving former health secretary in British political history.

So this is where health comes in, and we're fortunate to have in the new Chancellor the longest-serving former health secretary in British political history.

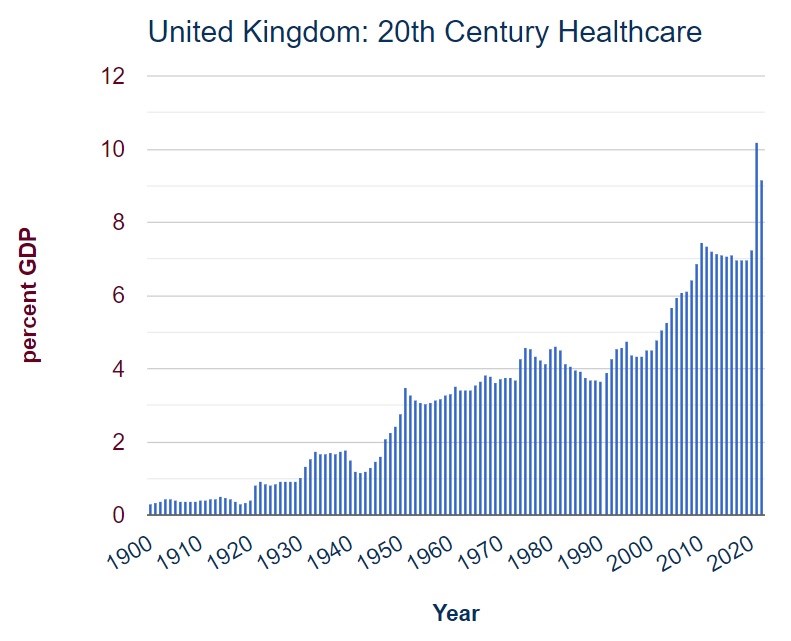

Government spending on health and social care is colossal and growing (as he stated in the quotation above) and, as we noted last week, it is primarily driven by thoroughly outdated socialist ideas of universal ‘free at the point of delivery’ provision (image source: https://www.ukpublicspending.co.uk/healthcare_spending).

It's time to crack our addiction to seventy years of electoral bribery: a system that handicaps targeted help to the most needy while at the same time giving free service to those who are well able to pay for their own needs cannot be described as anything other than electoral bribery. In any case, there’s little left for the Conservatives to lose in terms of voting intentions — so now is definitely the time to correct this seventy year-old injustice first introduced by the post-war Labour government.

Health spending is expected to account for £167.9 billion in 2022-23, or 41% of all central government departmental expenditure. In 2020 it was just over 7% of GDP, but it increased sharply in response to COVID-19 to over 10% of GDP in 2021.

There are approximately eight million people in the United Kingdom with active private health insurance policies, accounting for c. 13% of the population; and about 53% of people say that they would like to invest in some form of health insurance scheme for their employees, or for themselves and their families. However private health insurance is primarily taken out as an employee benefit which falls away at retirement: precisely the stage when healthcare demands start to increase significantly.

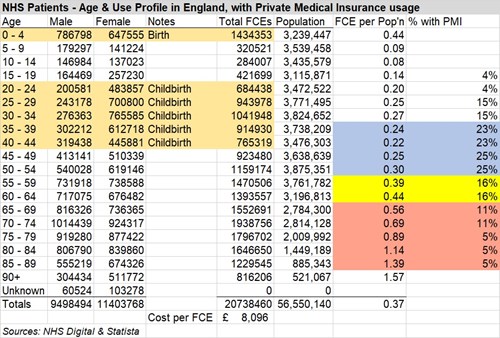

Research published by Statista provides the age distribution of adults with private medical insurance throughout the United Kingdom in 2017. It shows how the percentage of cover drops from 25% in the 45-54 age group, to 16% for 55-64s, 11% for 65-74s, and then just 5% for those aged 75 and over. Precisely at the stage when the demands of healthcare costs are at their highest, the state is left carrying this burden:

Using ‘Finished Consultant Episodes’ as a yardstick and excluding birth impact, the average quantum of healthcare by annual cohort more than doubles from 140,482 for those aged up to 64 to 299,352 for those aged 65 and over; if that £167.9 billion cost is broken down on the same basis, the aggregate cost of looking after the 10 million people in these 30 years of old age is the same as looking after the 37 million aged up to 65.

Private medical insurance for those aged 70 or more is not cheap: speaking from experience, for a relatively healthy couple it can be estimated at c. £7,500 pa. But where retirement follows a successful working life in terms of both income and capital, there is a significant proportion of the population who could reasonably be asked to carry this burden: ONS figures show that median individual wealth rises from £138,346 across ages 16-64 to £305,099 for people aged 65 and over. It is certainly not beyond the wit of HM Treasury mandarins to work out how to determine those able to pay these premiums.

NHS frontline services would not be affected by these arrangements, because those paying premiums would still be able to call for healthcare ‘free at the point of delivery’. But NHS accountants would be able to draw down payments from their private medical insurers to meet the costs of care for those for whom this cover was required. Greater use may well impact their premiums: so no doubt people would be encouraged to stay fit and healthy in body and mind for as long as possible.

Because the impact of health care costs is so weighted In favour of the elderly, I would estimate that most of Jeremy Hunt’s £20 billion shortfall should be recoverable by this mandatory private health insurance for wealthy people; but more to the point for those interested in inter-generational fairness, it will halt the injustice whereby young people are paying through their taxes for the health costs of those old folk who are well able to afford it.

A final thought — and one which we have made on a number of occasions, including last week: if a programme of training for old age were to be introduced at retirement, we should be able to maintain a much improved standard of health for old people generally: thus significantly reducing the extent of those calls on the NHS at this stage of life. These courses could be offered by the private medical health insurers, who would need little encouragement from Government to raise their profile.

So — in the planning for the Chancellor's restoration of fiscal responsibility, we suggest bringing together his experience in both health and the economy in order to reduce significantly the burden of healthcare costs on the Exchequer.

Gavin Oldham OBE

Share Radio